Starting your career as a financial advisor is both exciting and intimidating. With so many opportunities comes a variety of potential struggles. With so many bases to cover, it’s natural that you may feel overwhelmed.

However, being a financial advisor is worth the occasional stress that comes with the job. You just have to learn how to use your time effectively in order to avoid any and all unnecessary missteps. Here are seven tips for being a successful financial advisor with a long and enjoyable career.

1. Invest in Business Development

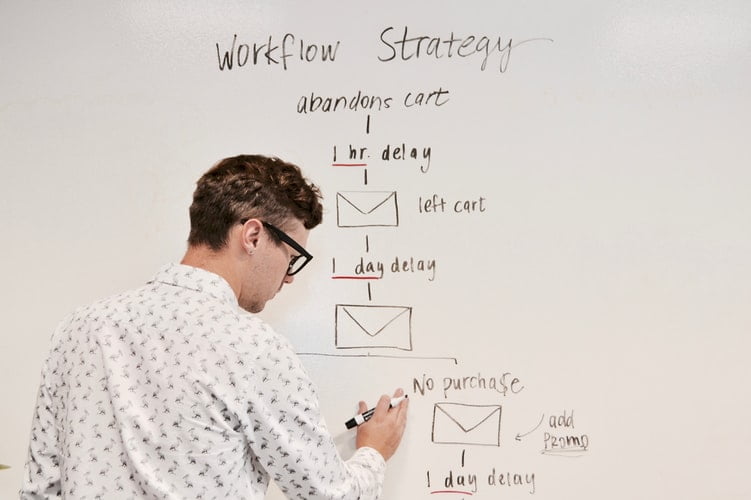

This should be evident to everyone: You have to put in the time and effort for business development. The issue is finding the time to do so and still balance the work you’re doing for clients. However, your pipeline will quickly dry up if you don’t carve out time for the business development activities. Without it, your workflow will become inconsistent, making it less likely to lead to growth.

This is the work that requires some investment on your part. The key to holding yourself accountable is to create a schedule for your work hours. For example, start by setting out 20% of your weekly time to spend on activities aimed at promoting your business. Create a list of goals, prioritize them, and create deadlines for yourself to complete them.

2. Educate Yourself

Being a financial advisor requires some room for a learning curve. Throughout your career, you’ll learn a lot of new things. You should always be seeking out the newest and most insightful info to ensure your services are the best they can be. Learning is especially important, though, at the beginning of your career.

Take courses in selling your services so you know how to market yourself. Watch YouTube videos that give free industry advice. You should also consider employing a business coach and joining a professional industry association. Plus, incorporate some informative trade books, podcasts, and articles to ensure you’re staying up to date on best practices.

3. Prioritize Digital Marketing

If you don’t have a thorough digital marketing strategy, you’re limiting yourself. The world of digital marketing can do wonders. Utilize social media to showcase the benefits of your services and run advertisements. Develop an email list to keep in touch with past, current, and potential clients. Digital marketing is definitely worth outsourcing to an expert you can trust.

One of the best and most important investments to make is in your website. Your financial advisor website is essentially your business’s digital storefront. It should offer all the information a potential client needs to know about you, including how to easily get in touch with you. Once you have a website, consider including some content marketing like a blog and make sure everything is SEO-friendly so you’re easy to search online.

4. Make it Personal

Personal experience is crucial to building long-term partnerships with clients. It’s the little things that make all the difference: Send thank you notes, share articles you think they’ll find helpful, and check in on them to see how they’re doing. Be sure to make your interactions not all about business and try to build a rapport with your clients.

When it is about business, take the time to really listen to their client. Ask specific questions and go deeper than the surface. Then explain how you’ll tailor your service to meet their specific needs and goals. This will make your client trust you and want to work with you long-term.

5. Don’t Overcomplicate Things

Speaking of explaining your services to clients, try to avoid using too much financial jargon. You never want a client to leave a conversation with you feeling more confused than they did going into it. You also don’t want to come across as condescending by over-explaining things.

Use as much simple language as possible. If they don’t know what something means, then educate them. You want to show that you’re committed to giving them the tools they need to be successful and to make big decisions. Explain exactly how working with you fits into their big picture, and make sure they understand all risks and costs associated with the process.

6. Ask For Help

Most successful people realize that they can’t achieve everything on their own. Mentors and peers are always available to them, and they have colleagues with whom to discuss topics. Those who have more experience should be the first place you go for advice. Leverage your connections in the financial planning and advising sector to grow your business.

Also, don’t be afraid to outsource help. As a financial advisor, you’re busy enough without having to keep up with administrative work. Having an assistant or some other form of outside help doesn’t mean you’re weak, it means you’re smart. Stretching yourself too thin will only result in burnout, which can lead to chronic stress if not dealt with.

7. Be Active in Your Community

If you want to be successful, visibility in your community is critical. Get involved by volunteering and donating your time and money. Focus on a subject or cause that you feel strongly about, and strive to make a difference in. Keep in mind this must be a genuine effort on your part: There must be no hidden motive.

People are interested in working with those who have shown they have real values. Plus, you’re building a more authentic connection, which is something you can’t automate or fake. When you enthusiastically engage in a cause, people will trust and admire you. Once your prospects find your passion, the process of moving them from prospects to clients is a lot easier.

In Conclusion:

Being a successful financial advisor requires more than just knowing yourself and having a few clients. The career path of a financial advisor can be a fruitful one. It’s important to never just “wing it” – lean on others in your field and always look for room for improvement. Building a genuine connection to your clients and community will help make your work even more fulfilling.

Read Also: