The modern world has become digitally advanced, and everything’s on the tip of one’s fingers. The working class of the modern world is all about using technology to solve the maximum problems in their lives – including money management.

Money Fintechzoom review found that it is a useful tool for corporate employees. Especially those who want to stay stress-free when it comes to managing their moolah.

The integration of technology in almost every aspect of our lives has pushed various sectors to change how they operate. One such sector that quickly adapted to the changes of the digital era is the financial sector.

The integration of technology in the processes of this sector has led to a buzzword (much more than that, trust me! The Fintech vertical is the brand new, shiny version of the financial sector that incorporates technology to provide a seamless user experience. Not just that, technology integration has taken the financial sector to a greater height – operationally.

Let’s explore more in the following sections.

What is Fintech? A Deep Dive into the Newbie

FinTech or Financial Technology is the amalgamation of technology and financial services that enhance consumer service provision. This can be thought of as the financial sector revamped – how the sector has adapted to the technological advancements in the modern era.

Staying relevant is something that every business wants – this is what keeps the money rolling for them. Financial institutions like banks rapidly change their policies and operational processes to stay relevant.

Regulatory bodies govern various sectors, especially those where customer handling is involved. Financial sectors need to adopt technological advancements to stay compliant with these regulations.

This is how the sector can improve the security and privacy of their customers by ensuring their data is safe with them. How is it relevant? In the recent year, there has been nearly a 75-80% increase in the number of data breaches in the past two years.

This is an alarming statistic as it shows how there was a crack that allowed hackers into systems. Be it the medical sector or the financial sector – both go through millions of customer data that need to be protected from hackers.

How Does That Help?

All of these are dreadful in the wrong hands, from sensitive data such as address or health issues and medication to the customer PIN, phone number, and social security number.

This is why better technology to protect consumer data and other sensitive information in such sectors is where FinTech was born. The primary concern with running financial institutions is breach – this can also cost the institution monetarily and customer-wise.

Technology in financial services improves it by enhancing the efficiency of previously time-consuming processes- getting a bank statement, for instance.

FinTechZoom is a one-stop solution platform that’s highly intuitive and brings in a lot of insights from experts for anyone interested in the sector. The platform isn’t just helpful for those beginning to know about the sector or a particular investment scheme; it is resourceful for even seasoned investors.

Money fintechzoom is a valuable section on the platform that helps users gain knowledge on the topic. Let’s find out more in the next section.

Impact of Money FintechZoom on Finance

The platform is a great space for anyone looking to improve their basic knowledge of the Fintech sector. The Money fintech Zoom category of the platform offers varied information across different domains, such as insurance, mortgages, loans, and personal finances, among others.

You can find expert advice and in-depth articles on the platform about the different avenues of money management. An average person would want to know the best investment opportunities, improving credit score, and basic financial transactions such as money transfers overseas.

That’s the diversity of the platform’s information sharing – making it a remarkable hub for resources that are great for anyone curious to know more about handling their finances.

Whether investing, getting credit cards, or handling loans, money fintechzoom makes finance easier for non-finance people. With the help of its extensive resources – be it to fill the knowledge gap or the technological one – the platform is filling it expertly.

Even if you are not interested in investment or getting a loan for your business – the platform makes personal finances easier for the masses. And all of these without subscribing to the pro version.

Summarizing:

- Cost-effectiveness as fintech services offer lower fees in comparison to traditional banks.

- Accessibility due to its user-friendly interface that makes information and other resources available for everyone.

- Innovative investment opportunities on money fintech Zoom allow users to explore new opportunities apart from the traditional ones. Users are exposed to cryptocurrency and fractional shares, which are quite different.

- The platform provides real-time data analysis that helps users understand their spending habits. They can also get access to tools that help them analyze investment performance and overall financial health.

Rise of Money Fintechzoom

People can get a lot of knowledge about the Fintech landscape for free. The pro version of the platform – fintechzoom pro is helpful for investors to track different asset classes. With the help of technology, the platform ensures people can keep close track of everything.

You can even get updated Bitcoin prices on Fintechzoom and learn from the personal finance mistakes of experts! Money fintechzoom has made it easier to get ahead with automatic investing. No longer queues for just an investment scheme you want to know about.

Money Fintechzoom helps you discover how fintech tools can help streamline your finances and provide you the extra perception and efficiency. The platform also acts as a budgeting app, allowing people to control spending.

A robo-marketing consultant can help them grow their funds with just a few clicks. These are great for growing your funding portfolio and making non-public finance easier, even for beginners.

Technology Behind Luxury FintechZoom

Luxury and finance intersecting seamlessly does not seem like a far-fetched idea. But here we are with luxury fintechzoom that brings the best of both worlds with luxurious ways of life, meeting the advancements of the financial era.

In addition, money fintechzoom provides several features that make it seem luxurious. No, it’s not just the pro version. The bespoke banking solutions and the one-of-a-kind investment opportunities all make for a great experience for people seeking exclusivity in each economic interaction.

Let’s see how the platform is changing the traditional banking landscape.

How Money Fintechzoom is Changing Traditional Banking?

Traditional banking did not bring automation and time-saving processes at the tip of the customer’s fingertips. With money fintechzoom, users across age groups can gain direct access to information in simple language that makes it easy to navigate even the most complex concepts, such as loans.

No more displeasing experiences at the bank branch with rude staff who do not want to spare even a minute to clear your doubts. With this platform’s help, you can access a plethora of information – from how to set up a personal finance budget to the interest rates that exist.

These things make it possible for you to manage your finances better without making you dependent on professional help. Professional help is essential in cases such as going through a significant life event such as retirement or pursuing higher education.

Benefits and Challenges of Using Money Fintechzoom

The primary advantages of using money fintech Zoom include the following:

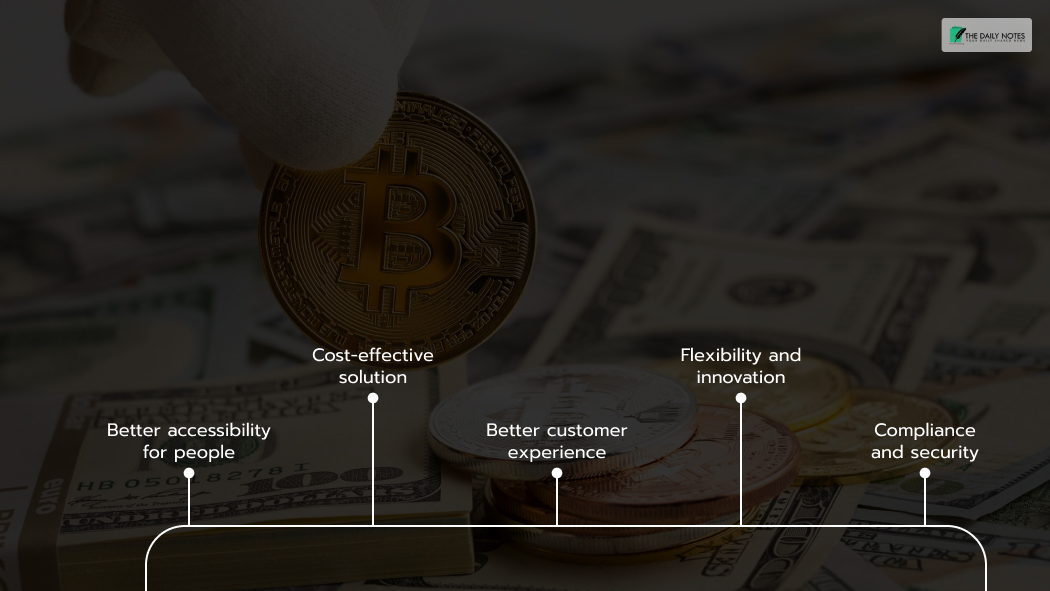

Better Accessibility for People

The platform is great for improving accessibility for people and bridging financial gaps through services to unbanked or underbanked populations.

The digital-first approach allows users to access financial tools and resources anytime, anywhere, with an internet connection.

Cost-Effective Solution

The money fintechzoom is an innovation solution that reduces transaction costs, streamlines processes, and eliminates intermediaries. This makes it a cost-effective solution for both businesses and consumers. Automating financial operations makes users improve efficiency and save on operational costs.

Better Customer Experience

The user-friendly interface helps personalize services. Moreover, money fintechzoom enhances customer experience through instant transactions, real-time updates, and access to various tools that make managing their money easier.

Flexibility and Innovation

The platform supports flexibility by integrating advanced technologies such as machine learning, AI (soon), and blockchain. This fosters innovation and enables users to access features such as budgeting tools, customized financial planning, and automated savings options.

Compliance and Security

The robust compliance frameworks and the enterprise-grade security measures ensure safe transactions. These also ensure that global financial regulations are followed, which builds trust among users and mitigates the risk of fraud.

Trends in Money FintechZoom

The current money fintech zoom trends include the following:

- Blockchain and crypto are leading the sector in transforming traditional finance. The platform also provides users tools that help monitor crypto investments and analyze blockchain trends.

- Digital wallets on the platform help users make payments conveniently by ensuring secure and instant payments. It is also instantly gaining popularity.

Future of Money Fintechzoom

The future of fintechzoom is looking bright due to the further integration of emerging technologies such as AI-powered financial advice, decentralized finance or DeFi, and advanced analytics. In addition, the innovations are expected to redefine personal finance management.

This makes it more personalized and accessible to a global audience.

Wrapping It Up!

That was all about the contribution of money fintechzoom in making finance easier for non-finance people. The upward trend of the financial era amidst the boost in technological innovations led to the interaction between the two sectors.

The platform highlights how fintech is bringing economic services to an underserved population. In addition, the services are enhanced by incorporating technology and other resources that allow users to improve their financial futures.

Regardless of their earnings or educational background, the platform is great for gaining information on basics to the most complex financial concepts.

Read More: