Financial advisors provide guidance and advice to individuals who help manage their finances. These professionals help in investment planning, savings, retirement, and tax strategies. Wondering how to become a financial advisor?

They also help in estate planning and budgeting to achieve financial goals effectively. Financial advisors are registered and not licensed. These professionals help people achieve their financial goals quickly.

They allow you to create a roadmap to achieve the desired monetary goal without hindrances. From assessing your financial health to suggesting the best way forward – they’re always there to help you.

The following article will explore how to level up your career and become a financial advisor. Before you take this career path, let’s look at the skills, time taken, and considerations.

Who Are Financial Advisors? Their Importance In Your Life

A significant part of their role includes making their client confident in the financial decisions they make. This empowers their clients to make the right financial choices that help them reach their targets with proper financial management.

A successful financial advisor will help you feel relaxed about the financial journey while they also take care of your finances. They are specialists in finance management and investment strategies, playing a crucial role.

It may seem like an unattractive career, but you can make the most out of this choice by honing your skills. You can help people make financial decisions, including making investments and other courses of action for them.

In addition, as a financial advisor, you are an essential part of the client’s life as you help your clients follow a personalized investment plan aligned to their needs.

Moreover, a financial advisor’s importance is understood in that they can provide tax advice while also helping you invest in the stock market.

From proper wealth management to insurance planning, a financial advisor is an asset for you – helping you achieve your monetary targets quickly.

A good financial advisor has many responsibilities, and they have the passion, experience, and desire for growth. They are specialists who help clients with their expertise and have a financial goal you can achieve.

You may have a financial goal, such as buying a mansion in Beverly Hills or going on that world trip after reaching a certain financial number. A financial advisor will help you make financial decisions with proper information and confidence.

Financial literacy is missing in the population’s majority (48% as per recent findings).

Let’s look at the best tips to become a certified financial planner.

Eligibility to Become a Financial Advisor

Most brokerage firms you may join require the new financial advisors to have at least a bachelor’s degree in the majors listed above. It must be from an accredited educational institution.

Another eligibility is to pass the Series 7 test and receive the General Securities Representative license. This test is essential because it covers the knowledge and regulations necessary for a financial advisor.

You must also have a Series 63 license, as it allows you to conduct business across different states. The other permits depend on your preference and the state in which they are operating.

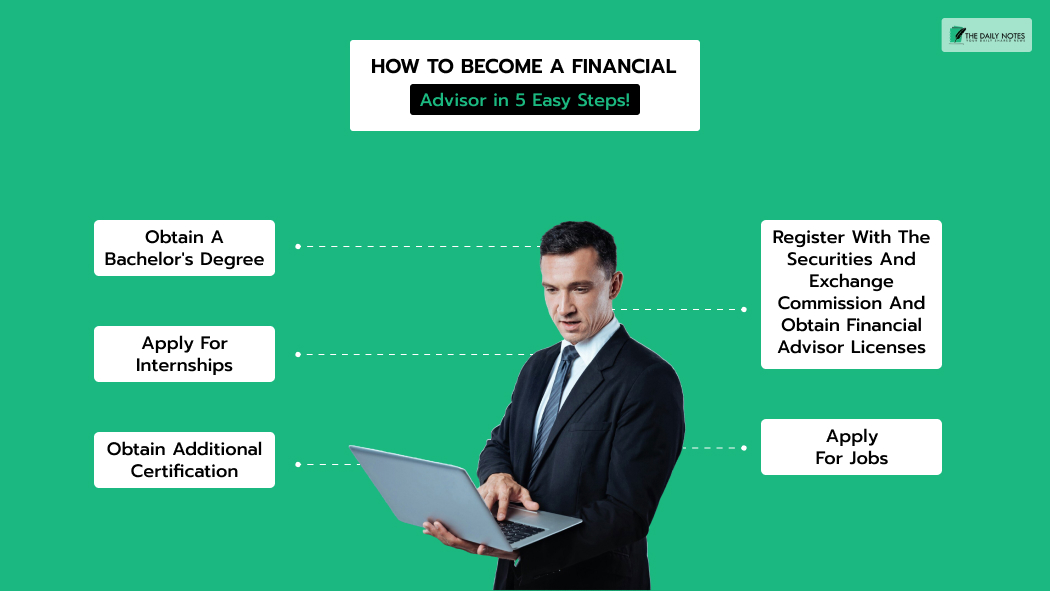

How to Become a Financial Advisor in 5 Easy Steps!

For you to become a financial advisor, here are some tips that you need to follow:

1. Obtain a Bachelor’s Degree

If you’re still in high school or about to enroll in a college – pick a bachelor’s degree in finance or a related field. This will prepare you for the career ahead. Some suitable degrees are:

- Economics will allow you to learn about business administration and financial matters and theory

- Accounting is a degree that will help you master concepts such as financial planning, auditing, and cost accounting.

- Business is a major that will help you prepare for a career in financial administration. The career choice is excellent for you if you want to learn about business ethics, principles of finance, and managerial finance.

- Finance as a bachelor’s degree will help you master concepts such as investments, securities, and financial management.

These degrees are essential for you as they will help you fulfill your career goals and let you help people financially.

2. Apply for Internships

The next step is to apply for internships with a financial organization that helps you gain experience selling different financial products. These include bonds, insurance policies, stocks, and mutual funds.

The internship will help you work closely with senior advisors to learn the standard operating procedure and network with clients.

Completing an internship can help you gain the necessary experience to become a licensed financial consultant.

3. Register With the Securities and Exchange Commission and Obtain Financial Advisor Licenses

Before you dive into the markets for different asset classes, you must register with the SEC. This step is essential in becoming a certified financial advisor. You’ll need to pass the Financial Industry Regulatory Authority or FNRA exams.

Similarly, if you are pursuing this career outside of the US, you should look up the relevant regulatory bodies that can provide you with legit certification. You may also need to pass additional certifications such as:

- The Series 6 required to sell mutual funds

- Series 7 for selling common and preferred stocks and fixed-income investments as a stockbroker

- The Series 3 or 31 to sell commodity or manager futures contract

- Series 63 for satisfying state law registration requirements

- The Series 65 to conduct fee-based investment advisory services

- Series 66, which merges the Series 63 and Series 65 exams

All of these additional financial advisor licenses depend on the path you choose to continue in the future. You can check their requirements on the official site for SEC.

In addition, other certified financial planner certifications include:

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Chartered Financial Consultant (ChFC)

- Certified Fund Specialist (CFS)

- Certified Private Wealth Advisor (CPWA)

- Personal Financial Specialist (PFS)

The entry-level role is more than just a resume builder offering valuable financial industry experience.

4. Obtain Additional Certification

Once you have the primary certificate, you can pursue different certifications that help elevate your salary and reliability. You can choose an additional certification of Chief Financial Planner, Chief Financial Analyst, Chartered Alternative Investment Analyst, and Financial Risk Manager.

These roles and more can bring you different opportunities with their salary perks.

5. Apply For Jobs

Applying for jobs is the final step in becoming a financial advisor, as this will give you the hands-on training necessary to make a name for yourself. Build your resume and put all the experience and academic details along with the additional certification.

Using a search engine, search for financial advisor jobs matching the location, qualifications, and skill set. You can even reach out to professionals to get hold of firms currently hiring and if you can approach them. Do not freeze your old contacts, as they can be helpful here.

How to Become A Financial Advisor THESE Skills are Needed

The following are the necessary skills needed to become a financial advisor:

- Financial planning involves helping clients set and achieve their financial goals. You can help them create a budget, project cash flow, and develop a retirement plan.

- Interpersonal communication can help you build client relations. This is important as it enables you to adjust the communication per person or situation.

- Active listening is an essential aspect of effective communication that involves making an effort to understand the client’s perspective without interrupting them.

- Attention to detail is another essential skill that helps access the market insight and trends necessary to provide sound financial advice.

- Analytical reasoning helps provide solutions to clients based on all your information.

- Problem-solving skills that help adapt to unforeseen situations such that they help optimize the client’s investments.

If you’re wondering how long it takes to become a financial advisor, it depends on your chosen career path. Moreover, if you decide to start a career at your college, you can expect to become a professional by the time you finish your internship.

If you plan on switching careers and learning things from scratch, it can take anywhere between 6 months to a year, depending on the certifications and course you opt for.

Considerations Before Becoming a Financial Advisor

Why choose a career as a financial advisor? Well, for starters, the money’s good. You can expect to make a handsome salary in this career. So, now that you know how to become a financial advisor, you can hone the skills that you develop.

Moreover, the average salary for financial advisors in the US is around $48 per hour, which is nearly $9,580 annually, which is not a bad sum to take home.

The salary can differ depending on the qualifications, experience, and the firm you’re associated with. You’ll need more luck if you’re an independent financial advisor as the competition is quite challenging.

But it is possible when you focus on providing quality advice – this will help you gain clients that stay with you and act as a walking-talking advertisement.

The Bureau of Labor Statistics projects a 5% growth through 2030.

How to Become A Financial Advisor | Types of Financial Advisors

There are several types of financial advisors, some of which are:

- Robo-advisor who automates the investment process and builds a portfolio for your client

- A financial planner who works with clients to identify and achieve financial goals such as retirement, tax, and risk management planning

- Chief Financial Analyst who provides services such as asset and wealth management, commercial and investment banking, and insurance

- A Chartered Life Underwriter is an expert who advises on estate planning, life insurance, and risk management.

- A chartered financial consultant offers personal financial management, tax issues, and retirement planning.

- A financial coach is someone who advises on credit, budgeting, savings, and investments

Your salary and client base can vary significantly depending on the type of financial advisor career you choose. You can adopt digital tools that can help you improve the service and make tracking more accessible for your clients. These can become your USP – making your services attractive.

Wrapping It Up!

That was all about how to become a financial advisor and all the necessary skills that can improve your career. You can choose to become a financial advisor early on or make a career switch, both of which are possible.

You simply must make the decision and give yourself enough time to properly develop the skills and prepare for the necessary certification exams. This will help you become a successful financial advisor early on – bringing you several clients.

Read More: