Updating your insurance policy is not an enviable task. It can take a bit of accounting, inventorying, and research to do it right. But the New Year is an excellent time to tackle those big, necessary tasks. Reviewing your insurance is a very worthwhile task to handle.

You depend on your policy to cover the costs of replacing lost belongings and repairing damage to your home. If your policy turns out to be insufficient, you will wind up having to pay out-of-pocket after an emergency.

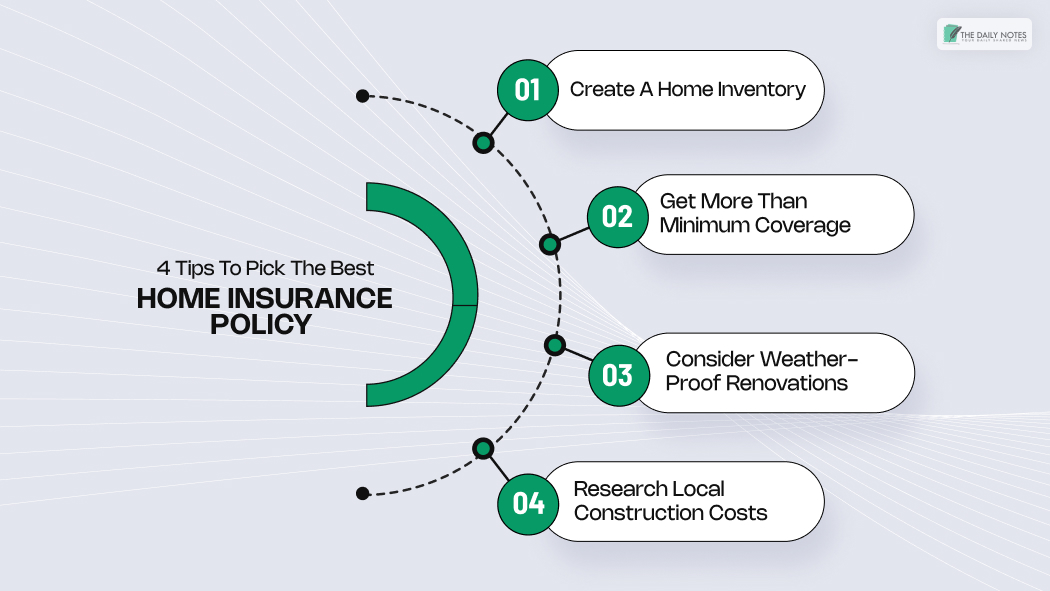

4 Tips to Pick the Best Home Insurance Policy

To ensure your insurance provides enough coverage in case something happens, follow these tips for updating your policy.

Create a Home Inventory

One of the most essential content insurance claims tips you can follow right now is creating a home inventory, which is a list of:

- Your family’s personal belongings on the property;

- Receipts or other records of their financial value;

- Records of their condition.

These factors are important to insurance adjusters when you make a claim. When you already have an up-to-date inventory, you can save yourself hours of time and stress.

Get More than Minimum Coverage

A big mistake cost-conscious consumers will make is getting the absolute minimum coverage their insurer allows. They look at their insurance premiums and want to save every dollar they can each month, so they opt for less insurance than they should. Often, that means their policy won’t cover the total cost of repairs or replacing their belongings.

Understandably, homeowners want to save. In some places, the average cost of home insurance is $104 per month or $1250 per year. As tempting as it can be, getting minimum coverage will prove more costly if something happens; the difference can be enough to put you in severe financial trouble.

You don’t need to overpay for insurance, but you should ensure you’re not under-insured. The best way to get appropriate coverage is to do the research yourself.

Create a home inventory that will give you an idea of the value of your personal belongings if you can, ask around to find out about building costs in your neighborhood. That can give you an idea of how much a total rebuild might cost.

Consider Weather-Proof Renovations

You’ve reviewed your coverage, and you need to raise your premiums. Meanwhile, the insurance company is raising rates so your coverage stays the same. One of the most significant factors in rising insurance premiums is the increasing severity of the weather.

It can start to feel expensive, but there are more innovative ways to save money than reducing your coverage.

Some renovations will help you reduce your rates. Renovations that protect your home include:

- Installing a sewer backup valve and sump pump;

- Renovate your plumbing system;

- Fix your roof;

- Reduce liability by installing an alarm system or a fence around your pool.

Research Local Construction Costs

Coverage for structural damage is one of the most expensive parts of your policy and one of the hardest to pay for if you’re underinsured. If you’ve been living in your home for a while, construction costs have likely changed, and that’s what your insurance pays for.

Construction costs have increased considerably faster than inflation. It’s essential to ensure your structural coverage reflects this increase.

These four tips will help you re-evaluate your insurance policy this New Year. Make sure you have coverage that keeps you protected!

Conclusion

That wraps up all the tricks you need to pick the best home insurance policy! Home insurance policy can seem tricky to choose and sometimes may seem useless, but beware! It is an important financial protection against damage or losses to your home or personal property.

The article lists the top 4 ways you can pick an insurance policy that fits your needs the best. Check out the following section to learn more about home insurance.

Frequently Asked Questions (FAQs)

Here are the common questions that can help clear your choice of the best home insurance policy:

A standard home insurance policy usually covers the physical structure of your home such as roof, walls, etc., and any personal belongings such as electronics, furniture, and clothes. It can also cover the cost of living elsewhere if your home is uninhabitable due to a covered event.

Home insurance policies do not cover the following:

• Wear and tear: Damage to your property due to aging of the home or regular use does not come under insurance coverage.

• Floods and earthquakes: These are natural calamities that require a separate policy.

• High-value items: Sadly, home insurance does not cover damage to expensive art, jewelry, or collectibles. These need additional coverage.

The premium of a home insurance policy depends on several factors such as:

• The location of your property – this helps the company know the rate of crimes or natural disasters in your area.

• Value of your home and replacement cost: The company determines the cost/premium depending on the cost of rebuilding your home.

• Any deductibles that you pay out of your pocket determine the premium amount. This is the amount that you pay before insurance starts – think of it as a down payment that reduces your future EMIs.

• Having home security, smoke detectors or fire alarms can reduce your premium.

Replacement cost coverage takes care of the cost of replacing your property with similar or new kinds of items. This ensures there is no reduction in the quality.

Whereas actual cash value pays the cost to replace or repair property, without depreciation. For instance, if a 5- or 10-year electronic gadget is stolen, ACV will cover the cost of the same.

Read Also: