In the era of digital transformation, the convergence of data and digital technologies has created a paradigm shift in the insurance industry. Smart insurance policy management software powered by data analytics is overhauling policy administration processes.

With data becoming more ubiquitous, it has laid a foundation for a data-driven ecosystem that can extract meaningful insights from customer and business information.

However, having such a framework for extracting meaning from unstructured, disparate data can be made possible only with the right tool.

An integrated and centralized insurance policy software enables insurers to process, handle, and work with data on all ends.

The Role Of Data Analytics In Insurance Policy Management Systems

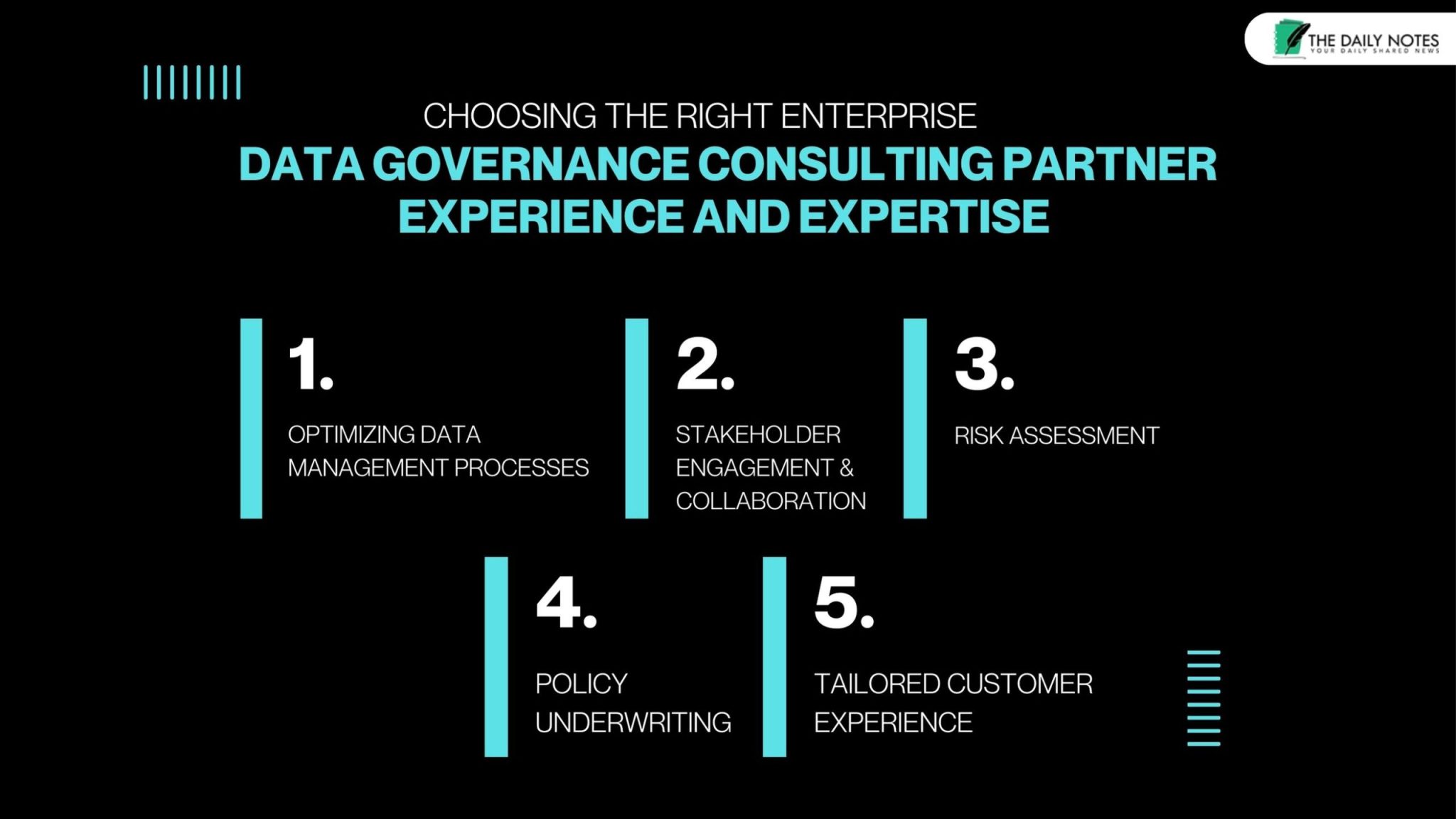

Given its multivariate use, insurance data analytics can be applied to various aspects of business operations and processes. To that end, here is how data analytics-powered policy administration systems benefit insurance businesses:

1. Fraud Mitigation

Detecting and preventing fraud can be an arduous process for insurance companies as essential data is held in silos. Insurance analytics can deliver data-driven insights to help insurance companies detect and prevent fraudulent insurance claims and provider payment abuse.

Harnessing the power and potential of predictive modeling, social media analytics, and big data across different states of a policy lifecycle empowers insurance companies to effectively and efficiently mitigate fraud.

By analyzing past data, trends, variables, claims history, etc, insurance data analytics tools can establish patterns and calculate the probability of fraud.

2. Operational Efficiency

By incorporating data analysis capabilities into insurance policy management software, insurers can optimize and automate business workflows. Traditional insurance policy management systems typically involved manual data entry, hefty paperwork, and repetitive processes.

Moreover, these manual processes were more susceptible to errors and inefficiencies. However, with data analytics, insurers can optimize these workflows while ensuring consistency and accuracy.

As routine times are automated, insurers can reduce the processing times. This enables insurers to respond more quickly to policy changes, updates, and customer queries.

3. Risk Assessment

Insurance analytics can help insurance companies carry out risk analysis in real-time. This facility, in turn, will enable them to become highly responsible in a highly volatile environment driven by internal or external stimuli.

For instance, connected automobiles can continually send a number of data points to servers every second. Insurance companies can get exact details of the location of the vehicles, their speed, braking, steering, and acceleration in real-time.

Additionally, insurance companies can share real-time updates on the state and condition of the route so that drivers can make calculated decisions on whether or not they should follow the path.

4. Policy Underwriting

Processing policy applications and establishing pricing for accepted insurable risks can be an arduous process. Underwriters have to go over volumes of data to determine the risk of a potential policyholder. When done manually or using legacy systems, the underwriting process can be extremely sluggish.

Moreover, insurance analytics paired with artificial intelligence can streamline and hasten the process to a great extent. It leaves ample room for underwriters to focus on high-value tasks that generate revenue and expand the business.

All in all, data analytics-powered insurance policy software can build an environment that is highly conducive to growth and increased efficiency.

5. Tailored Customer Experience

Knowing customer preferences and behaviors enables businesses to deliver tailored customer experiences. As such, data analytics enables insurers to understand customer journeys and build solid insurance policy management software.

It also helps in identifying the issues faced by customers. Insurers can leverage these insights to improve the customer experience.

Personalized customer experience not only improves customer satisfaction but also cultivates loyalty and advocacy.

Additionally, in the highly competitive insurance industry, the ability to offer a hyper-personalized customer experience is a key differentiator that resonates with customers and sets the business apart.

Growth Opportunities with Data Analytics

It is not new how the advent of data analytics has impacted the insurance industry. They have transformed the process of their operations and customer services with the incorporation of data analytics.

Moreover, the implementation of data analytics in insurance policy management has helped insurance companies in many ways. For instance, with data analytics, companies are able to price their policies more accurately and improve their risk management.

Additionally, with the help of data analytics, insurance companies are able to modify their policies to cater to individual customer needs. Furthermore, data analytics help with compensation claims, predicting future trends, mitigating risks, and reducing customer service costs.

Overall, the incorporation of data analytics in insurance policy management has helped companies with their efficiency, competitiveness, growth, and innovations.

Future Trends for Insurance Companies

With the ongoing craze of AI in the data analytics field, we can predict a significant transformation in insurance companies’ leveraging of data.

- They can employ AI tools and technologies to assess risks and analyze customers’ data.

- Moreover, companies can use advanced versions of data analytics for providing a personalized user experience to their customers.

- The AI incorporation in data analytics can possibly help in the prediction of risks. Moreover, this can help in assessing and mitigating risks faster.

- The insurance industry can take the help of data analytics to formulate new policies and products for their companies. Additionally, they can use the data to modify existing policies to serve the users better.

Final Words

Owing to the rapid advancements in technology and increasing usage of interconnected devices, insurance companies now have unprecedented access to large volumes of customer data.

Moreover, against such a background of brimming data reserves, it would only make sense to harness these assets to accelerate business growth.

As such, when choosing an insurance policy management system, insurers should ensure that the solution is equipped with advanced data analytics capabilities. Furthermore, it will help them make strategic decisions to grow and scale the business.

Read Also: