Legislation across the world requires both citizens and entrepreneurs to report their profits and income and pay the required federal taxes diligently. In any case, the way toward keeping up with tax compliance due to the ever-evolving tax laws can be testing.

It is more valid for individuals and businesses who work internationally and with people from all over the world. Indeed, even the complexities of filing and paying your taxes are always growing.

Companies with large budgets and resources hire professional tax accountants for help.

Nowadays, there is a developing interest in technology and innovation to improve tax compliance by decreasing business expenses and making it more straightforward for people to file taxes.

How can we adopt tax compliance in the digital era? What is the most effective method to incorporate technology into today’s business models to make tax compliance easy?

If you’re pondering over the same questions, you’ve come to the right place.

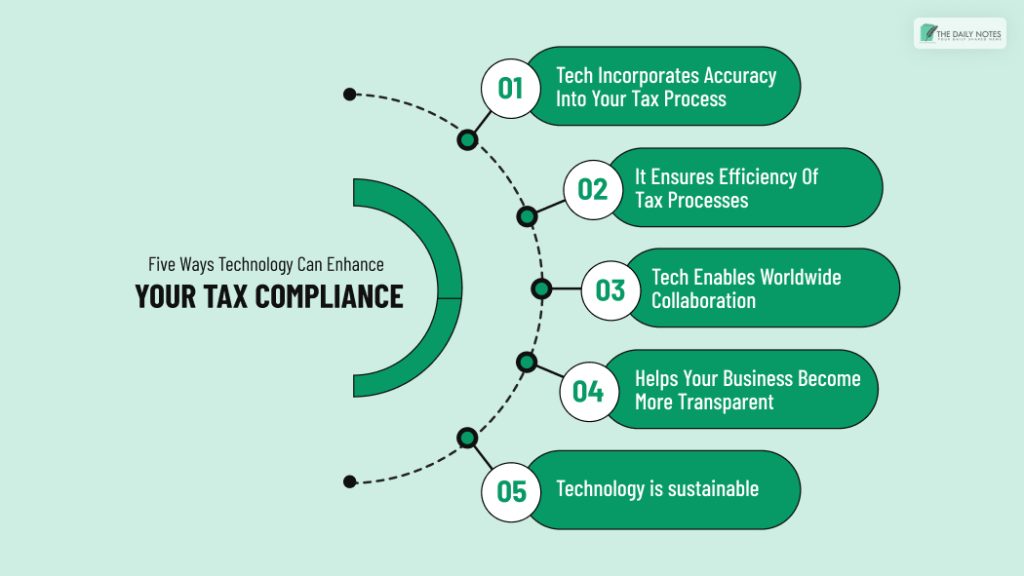

Here are Five Ways Technology Can Enhance Your Tax Compliance

Technology has been at the forefront of several innovations in various sectors. Tax compliance is one of those aspects that enjoys ease and accuracy through it.

Let’s check out its impact:

1. Tech Incorporates Accuracy Into Your Tax Process

From GAAP to BEPS to IFRS, there are various regulations that the tax department needs to follow. Such a thing increases the demand for these departments to provide accurate information regarding proof of the taxes paid, financial activity indicators, and business activities with their partners.

To ensure that they remain compliant, companies worldwide are looking towards tax-related technologies for a broader and more accurate tax reporting system.

Whether it is Self Employed Taxes or business-related taxes, there is no better way to produce accurate information without the aid of technology. Technology helps automate bookkeeping, auditing, and closing activities and removes human errors.

With an automated tax system, you can seamlessly pay taxes every year, pull up the history of tax payments, and execute reports efficiently.

Such accuracy and consistency of tax information provide auditors with the truth, and the ability to make last-minute changes and enable accurate and fast tax calculations.

2. It Ensures the Efficiency of Tax Processes

Tax-related technology is moving past your typical Excel spreadsheets and shared hard drives. Nowadays, dashboards, sign-on platforms, ERP migrations, and cloud-based systems allow users to standardize and streamline tax processes.

Such a need for efficient tax processes becomes ever-so necessary due to the shrinking of closings and small audit timeframes.

Regardless of what your tax expertise is, whether, in corporate income tax or property tax, there should be an emphasis on managing tax processes without doing them over and over again.

With tax-related technologies, you can safely and securely collect data and efficiently place it inside your tax documents. And, when accurate tax data is ever-present at your fingertips, maintaining tax compliance will be all so easy.

3. Tech Enables Worldwide Collaboration

Owning an international business has its challenges when it comes to corporate tax. Most of these businesses do not conduct tax operations globally because it is always better to do them on-site.

Tax-related technologies offer them a solution for changing global work-from-home policies and time-zone issues by allowing them to conduct their tax operations continuously.

Once they standardize their tax process, their functions can run without any hiccups because another team from elsewhere can pick up from where the on-site team left off.

Conducting business operations internationally also imposes a language barrier. It can lead to misinterpretation of tax information, which eventually leads to compliance issues.

Furthermore, tax accountants and authorities are only available during business hours in a specific country.

Those hours might not be suitable for you or for the country in which you conduct your business. Tax technologies offer business owners a solution to break down this language barrier and share data with everyone related to their business worldwide.

4. Technology Helps Your Business Become More Transparent

Transparency is of the utmost importance in every business operation these days, whether it be taxes or equipment procurement.

Usually, tax-related processes such as bookkeeping and customs work independently. However, they have united into one small package.

Tax technology allows businesses to break down this bond between the two. This ability to calculate taxes separately and according to different financial aspects will enable companies to give their tax department better insight into the tax calculation process.

Furthermore, the OECD (Organization for Economic Co-operation and Development) commits to pushing governments to enforce transparency so that companies can comply with local and federal taxes.

Such openness with tax information will allow businesses to avoid financial, valuation, and reputational repercussions.

5. Technology is Sustainable

It would be best to elevate your tax department’s strategic focus and visibility to prepare them for the future. There are various instances where businesses that adopted technology got disrupted because they never used it before.

However, some were ready and adapted to it, but most of them remained in the dark about how to adapt and utilize technology effectively.

The only way your tax department will be efficient is when you visualize where you want it to be in the future and develop a sustainable tax framework. The tools and tax software you use these days will become outdated and change five to ten years down the line.

And you will have to be open to such a change to keep pace with the finance world or risk being in the last position. The longer you wait to adopt tax technology, the more you put yourself at risk of facing tax compliance issues.

After all, changing with the times and adopting a sustainable tax process is the best decision for you and your business as a whole.

Conclusion

It is a fact that managing your taxes efficient’ly impacts your company’s mission statement and goals. If you cannot handle that risk properly, it will result in financial issues and damage your business’s reputation.

Utilizing the latest technology provides your business with tools to tackle all tax compliance and related problems.

Consider how technology can enhance your tax compliance and incorporate it into your tax process as soon as possible. It will provide you with never-ending benefits in the long run.

Read Also: