Businesses in high-risk industries need a secure payment processor. That is, with strict regulations and exposure to various charges, a reliable solution is scarcely available.

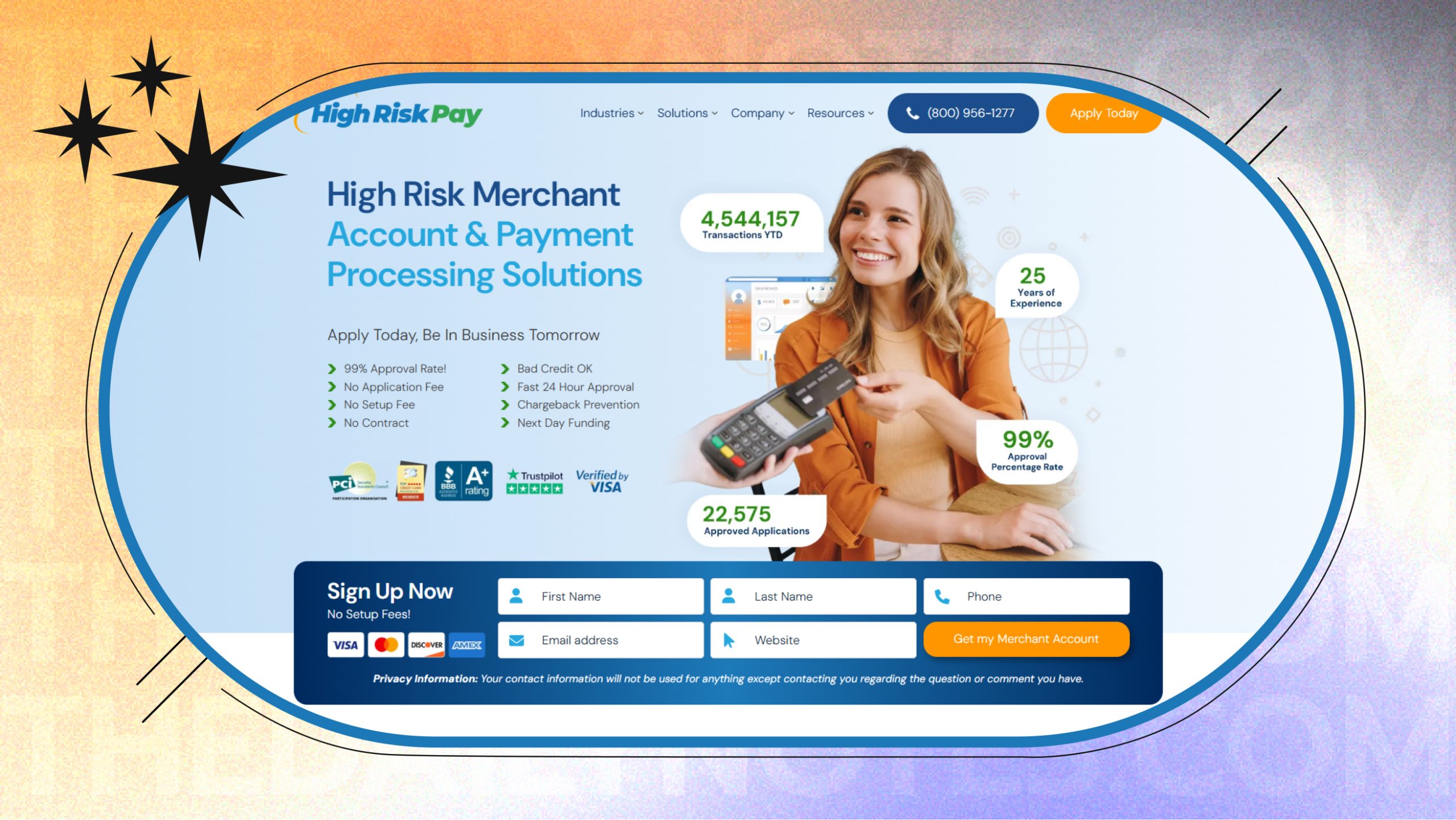

But now no more. This scarcity is finally covered by HighRiskPay — a platform offering secure and adaptable transaction processing solutions.

Moreover, the platform provides personalized processes that allow businesses to tailor the methods according to their direct needs.

So, if you are also curious about how to use the platform for your business needs, I have brought the perfect guide.

In this article, you will learn all about the high-risk merchant account at HighRiskPay.com through the exploration of—

- Its services, benefits, and challenges,

- Applications in real-world scenarios,

- Pricing models, key considerations, and more.

So, keep reading to learn more!

What Is A High Risk Merchant Account At HighRiskPay.Com?

First things first, HighRiskPay is a platform that is known for its high-risk merchant accounts and transaction services specially offered to businesses.

Now, in various sensitive industries, businesses often face rejection from traditional banks for funding.

So, HighRiskPay offers a secure platform to allow these businesses to process their transactions through credit card payments, financial rates, and conventional payments.

Making it easier for high-risk businesses to secure payment processing from the platform without going through complex issues or rejections.

1. Services Of HighRiskPay

Given that HighRiskPay functions around high-risk businesses, it offers curated services for these business verticals to process their payment transactions.

So, some of these services include—

- High-Risk Merchant Account: Allows businesses in high-risk industries to secure payment transactions efficiently.

- Bad Credit Merchant Account: Allows businesses with poor or bad credit to ensure secure payment processing.

- E-commerce Payment Processing: Offers competitive fees for e-commerce accounts that allow businesses to run smooth online payments.

- CBD Merchant Account: Provides customized merchant accounts for seamless payment processing.

- Startup Support: Supports startup businesses and freelancers to ensure they have long-term stability.

- ACH Processing: Allows businesses to directly process the payment through debit or credit cards in automated clearing house.

- Chargeback Management: Services to avoid heavy chargebacks and financial losses for businesses.

2. Benefits Of HighRiskPay

Now, HighRiskPay offers massive benefits to high-risk merchants. Some of these include—

- Allowing high-risk industries to make secure payment processing.

- Reducing the high chargeback ratios for businesses.

- Allowing businesses to go global even in risky regions without fear.

- Offering subscription services to businesses for recurring bills.

- Addressing risks and secure payment processing for high transaction values.

3. Applications Of HighRiskPay

Given that HighRiskPay generally supports businesses in the risky industries, it is mainly applied in industries—

- Adult entertainment,

- Online gaming,

- Travel and tourism business,

- Subscription services,

- Pharmaceuticals and other medical products, and

- Tech support for remote teams.

Why Do Businesses Need A High Risk Merchant Account At HighRiskPay.Com?

Even though it seems unnecessary at first, choosing HighRiskPay for a high-risk merchant account can be quite beneficial. So, here are the reasons to choose it—

- High Approval: Firstly, it accepts most of the high-risk businesses to offer a smooth payment processing. So, there is less chance of rejection.

- Zero Application Charges: Moreover, it does not charge the business for applying to the high-risk account creation.

- Fast Approval: Additionally, it instantly approves the payment processing within a 24 to 48-hour timeframe. So, businesses can secure the transactions fast.

- Avoid Chargeback: Also, it offers advanced tools and services that prevent financial losses and chargebacks. So, making it a safe and secure space.

- Next-day Funding: Finally, it provides next-day funds. So, businesses do not need to wait for days and months to process their payments.

How To Apply For A High Risk Account In HighRiskPay?

Unlike a conventional account, opening a high-risk merchant account at HighRiskPay.com is quite easy. So, here are the basic steps to get started—

1. Visit the official website of HighRiskPay.com and fill out the application form with your personal information.

2. Then, provide the required documents. That is, attach your identification proof, business documents, and your bank account details.

3. After that, sign the application with the DocuSign app to digitally edit the application form.

4. Finally, submit the form and wait for 24 to 48 hours to accept the payments through credit cards.

Pricing Models

Unlike the other digital payment processing platforms, HighRiskPay offers diverse pricing plans. So, here are some of the plans that users can choose from—

- Transaction Fees: It offers 1.79% transaction charges for businesses with a good credit score. So, they need to pay $0.25 per transaction.

- Monthly Charges: Moreover, it charges a monthly subscription fee of $9.95, depending on the type of business accessing their payment processing services.

- High-risk Category Charges: Additionally, the high-risk businesses are subject to an estimated pricing of 2.95 % over the $0.25 per transaction.

- Miscellaneous Fees: Finally, it also charges additional fees for virtual terminals, chargeback processing, and international payments.

Challenges And Limitations

Now, as a secure payment processing platform, it offers countless benefits to high-risk businesses. But it comes with its own set of challenges and limitations.

So, some of these limitations include—

1. High Processing Charges — It charges expensively compared to conventional banks for high-risk payments.

2. Rolling Reserves — In case of payment processing disputes, it can hold on to 10 to 15% of the sales for around 3 to 6 months.

3. Stricter Document Verification — If the approval process becomes stricter, it can impact the risk management procedures with stringent verifications.

4. Risk of Account Disabled or Suspended — If a violation of the policy is found in the document verification, then the business account can be disabled or suspended for a long time.

Things To Consider While Using HighRiskPay

Now, given the dynamic aspects and risks associated with HighRiskPay, businesses need to keep a few things in consideration. So, here are the things—

- Choosing suppliers who understand the legal and specific needs of the business.

- Verifying the service offers clearly for the businesses to avoid hidden costs.

- Checking for fraud detection updates and policies to safeguard the company against fraud.

- Ensuring the customer services are working fine 24/7 to manage any client issues with the transaction payments.

So, by keeping these few things in mind, businesses in the high-risk field can use HighRiskPay for faster, secure, and smooth payment processing.

FAQs

Here, I have curated some of the frequently asked questions on the HighRiskPay platform that most users look for.

1. What Documents To Keep Prepared For A Merchant Account?

Some of the documents required to create a merchant account at HighRiskPay include—

- Identification proof — government ID of any kind,

- Business license,

- Bank details and personal information,

- Recent financial or transaction statements.

2. What Payment Methods Does HighRiskPay Process?

Unlike other payment portals, HighRiskPay offers diverse payment processing options. Some of these include—

- ACH payments,

- Credit card transactions,

- e-Check payments,

- Customized payment solutions for high-risk businesses.

3. Can I Apply For A Merchant Account With Bad Credit?

Yes, absolutely. Even with a bad credit score, businesses can apply for a merchant account. So, they can instantly get approval for the funding with around a 99% success rate, even with a bad credit history.